NPKZ, INN, ECO, SEED, NTFD, DLTA |

||||||

|

Returns on assets and/or equity are too low

|

||||||

|

Management is not efficient

A preliminary look at the country |

||||||

NPKZ, INN, ECO, SEED, NTFD, DLTA |

||||||

|

Los retornos del activo y/o del patrimonio son muy bajos

|

||||||

|

La directiva no es eficiente

Un primer vistazo al país Join the conversation on

|

||||||

|

||||||

Title: VFM Who gets harmed by Deflation Shortionary | |

| Views: | Comments: 0 |

Title: H2O Car - Water Powered Car | |

| Views: | Comments: 0 |

Title: A DRAMATIC SURPRISE ON A QUIET SQUARE | |

| Views: | Comments: 0 |

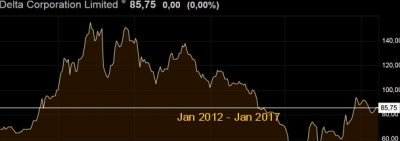

Nampak Zimbabwe Ltd (NPKZ), Innscor Africa Limited (INN), Econet Wireless Zimbabwe Limited (ECO), Seed Co Limited (SEED), National Foods Holdings Limited (NTFD), Delta Corporation Limited (DLTA)

Nampak Zimbabwe Ltd (NPKZ), Innscor Africa Limited (INN), Econet Wireless Zimbabwe Limited (ECO), Seed Co Limited (SEED), National Foods Holdings Limited (NTFD), Delta Corporation Limited (DLTA) Those returns are the percentage of the net income over the assets and/or over the equity. Net income is simply sales minus all costs of doing business, including taxes. When a company has over 20% profit margin, but has a return on assets lower than 7% and/or return on equity less than 17%, it seems to me that the management is just poor.

Those returns are the percentage of the net income over the assets and/or over the equity. Net income is simply sales minus all costs of doing business, including taxes. When a company has over 20% profit margin, but has a return on assets lower than 7% and/or return on equity less than 17%, it seems to me that the management is just poor. Nampak Zimbabwe Ltd (NPKZ), Innscor Africa Limited (INN), Econet Wireless Zimbabwe Limited (ECO), Seed Co Limited (SEED), National Foods Holdings Limited (NTFD), Delta Corporation Limited (DLTA)

Nampak Zimbabwe Ltd (NPKZ), Innscor Africa Limited (INN), Econet Wireless Zimbabwe Limited (ECO), Seed Co Limited (SEED), National Foods Holdings Limited (NTFD), Delta Corporation Limited (DLTA) Dichos retornos son el porcentaje del resultado operativo sobre los activos y/o sobre el patrimonio. El resultado operativo es simplemente las ventas menos todos los costes del negocio, incluyendo los impuestos. Cuando una empresa tiene unos márgenes superiores al 20%, pero el retorno sobre activos no llega al 7% y/o el retorno sobre el patrimonio no llega al 17%, me parece que la empresa no está bien gestionada.

Dichos retornos son el porcentaje del resultado operativo sobre los activos y/o sobre el patrimonio. El resultado operativo es simplemente las ventas menos todos los costes del negocio, incluyendo los impuestos. Cuando una empresa tiene unos márgenes superiores al 20%, pero el retorno sobre activos no llega al 7% y/o el retorno sobre el patrimonio no llega al 17%, me parece que la empresa no está bien gestionada.