Date: 09-17-2016

Views: 24956

Your Comments: 0

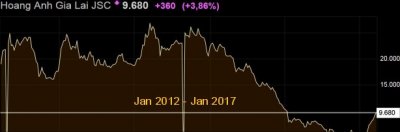

HAG, HNG, PPC, SBT, MSN, VHC, CII, HSG, GMD, DCM, PNJ, PVD, NT2, FPT |

|

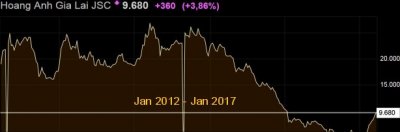

These companies have too much debt compared to EBITDA

Hoang Anh Gia Lai JSC (HAG), Hoang Anh Gia Lai Agricultural JSC (HNG), Pha Lai Thermal Power JSC (PPC), Thanh Thanh Cong Tay Ninh JSC (SBT), Masan Group Corp (MSN), Vinh Hoan Corp (VHC), Ho Chi Minh City Infrastructure Investment JSC (CII), Hoasen Group (HSG), Gemadept Corp (GMD), Petrovietnam Camau Fertilizer (DCM), Phu Nhuan Jewelry JSC (PNJ), PetroVietnam Drilling & Well Service Corp (PVD), PetroVietnam Power Nhon Trach 2 JSC (NT2), FPT Corp (FPT). Hoang Anh Gia Lai JSC (HAG), Hoang Anh Gia Lai Agricultural JSC (HNG), Pha Lai Thermal Power JSC (PPC), Thanh Thanh Cong Tay Ninh JSC (SBT), Masan Group Corp (MSN), Vinh Hoan Corp (VHC), Ho Chi Minh City Infrastructure Investment JSC (CII), Hoasen Group (HSG), Gemadept Corp (GMD), Petrovietnam Camau Fertilizer (DCM), Phu Nhuan Jewelry JSC (PNJ), PetroVietnam Drilling & Well Service Corp (PVD), PetroVietnam Power Nhon Trach 2 JSC (NT2), FPT Corp (FPT).

|

|

A recession could make them go bankrupt

Total debt of these companies is over 3 times the EBITDA (the core business operating profit, or the earning power of the company from ongoing operations). And that is too much for me. It would take them over 3 years to repay their debt. In bad times, or a big recession, the EBITDA might be cut to half, but debt remains the same. That means they would need way over 6 years to repay their debt, which would force them to work for the bank, if not worse. Total debt of these companies is over 3 times the EBITDA (the core business operating profit, or the earning power of the company from ongoing operations). And that is too much for me. It would take them over 3 years to repay their debt. In bad times, or a big recession, the EBITDA might be cut to half, but debt remains the same. That means they would need way over 6 years to repay their debt, which would force them to work for the bank, if not worse.

A preliminary look at the country

|

|

HAG, HNG, PPC, SBT, MSN, VHC, CII, HSG, GMD, DCM, PNJ, PVD, NT2, FPT |

|

Estas empresas tienen demasiada deuda comparada con el EBITDA

Hoang Anh Gia Lai JSC (HAG), Hoang Anh Gia Lai Agricultural JSC (HNG), Pha Lai Thermal Power JSC (PPC), Thanh Thanh Cong Tay Ninh JSC (SBT), Masan Group Corp (MSN), Vinh Hoan Corp (VHC), Ho Chi Minh City Infrastructure Investment JSC (CII), Hoasen Group (HSG), Gemadept Corp (GMD), Petrovietnam Camau Fertilizer (DCM), Phu Nhuan Jewelry JSC (PNJ), PetroVietnam Drilling & Well Service Corp (PVD), PetroVietnam Power Nhon Trach 2 JSC (NT2), FPT Corp (FPT). Hoang Anh Gia Lai JSC (HAG), Hoang Anh Gia Lai Agricultural JSC (HNG), Pha Lai Thermal Power JSC (PPC), Thanh Thanh Cong Tay Ninh JSC (SBT), Masan Group Corp (MSN), Vinh Hoan Corp (VHC), Ho Chi Minh City Infrastructure Investment JSC (CII), Hoasen Group (HSG), Gemadept Corp (GMD), Petrovietnam Camau Fertilizer (DCM), Phu Nhuan Jewelry JSC (PNJ), PetroVietnam Drilling & Well Service Corp (PVD), PetroVietnam Power Nhon Trach 2 JSC (NT2), FPT Corp (FPT).

|

|

Una recesión podría hacerlas quebrar

La deuda total de estas empresas es más de 3 veces el EBITDA (el beneficio operativo principal del negocio, o las ganancias de la empresa en su día a día). Y eso es demasiado para mí. Necesitarían más de 3 años para pagar sus deudas. En vacas flacas, o en una gran recesión, el EBITDA puede bajar a la mitad, pero la deuda se mantendría. Eso significa que necesitarían bastante más de 6 años para pagar la deuda, lo que las obligaría a trabajar para la banca, si no algo peor. La deuda total de estas empresas es más de 3 veces el EBITDA (el beneficio operativo principal del negocio, o las ganancias de la empresa en su día a día). Y eso es demasiado para mí. Necesitarían más de 3 años para pagar sus deudas. En vacas flacas, o en una gran recesión, el EBITDA puede bajar a la mitad, pero la deuda se mantendría. Eso significa que necesitarían bastante más de 6 años para pagar la deuda, lo que las obligaría a trabajar para la banca, si no algo peor.

Un vistazo preliminar al país

Join the conversation on

|

|

|

Hoang Anh Gia Lai JSC (HAG), Hoang Anh Gia Lai Agricultural JSC (HNG), Pha Lai Thermal Power JSC (PPC), Thanh Thanh Cong Tay Ninh JSC (SBT), Masan Group Corp (MSN), Vinh Hoan Corp (VHC), Ho Chi Minh City Infrastructure Investment JSC (CII), Hoasen Group (HSG), Gemadept Corp (GMD), Petrovietnam Camau Fertilizer (DCM), Phu Nhuan Jewelry JSC (PNJ), PetroVietnam Drilling & Well Service Corp (PVD), PetroVietnam Power Nhon Trach 2 JSC (NT2), FPT Corp (FPT).

Hoang Anh Gia Lai JSC (HAG), Hoang Anh Gia Lai Agricultural JSC (HNG), Pha Lai Thermal Power JSC (PPC), Thanh Thanh Cong Tay Ninh JSC (SBT), Masan Group Corp (MSN), Vinh Hoan Corp (VHC), Ho Chi Minh City Infrastructure Investment JSC (CII), Hoasen Group (HSG), Gemadept Corp (GMD), Petrovietnam Camau Fertilizer (DCM), Phu Nhuan Jewelry JSC (PNJ), PetroVietnam Drilling & Well Service Corp (PVD), PetroVietnam Power Nhon Trach 2 JSC (NT2), FPT Corp (FPT). Total debt of these companies is over 3 times the EBITDA (the core business operating profit, or the earning power of the company from ongoing operations). And that is too much for me. It would take them over 3 years to repay their debt. In bad times, or a big recession, the EBITDA might be cut to half, but debt remains the same. That means they would need way over 6 years to repay their debt, which would force them to work for the bank, if not worse.

Total debt of these companies is over 3 times the EBITDA (the core business operating profit, or the earning power of the company from ongoing operations). And that is too much for me. It would take them over 3 years to repay their debt. In bad times, or a big recession, the EBITDA might be cut to half, but debt remains the same. That means they would need way over 6 years to repay their debt, which would force them to work for the bank, if not worse.  Hoang Anh Gia Lai JSC (HAG), Hoang Anh Gia Lai Agricultural JSC (HNG), Pha Lai Thermal Power JSC (PPC), Thanh Thanh Cong Tay Ninh JSC (SBT), Masan Group Corp (MSN), Vinh Hoan Corp (VHC), Ho Chi Minh City Infrastructure Investment JSC (CII), Hoasen Group (HSG), Gemadept Corp (GMD), Petrovietnam Camau Fertilizer (DCM), Phu Nhuan Jewelry JSC (PNJ), PetroVietnam Drilling & Well Service Corp (PVD), PetroVietnam Power Nhon Trach 2 JSC (NT2), FPT Corp (FPT).

Hoang Anh Gia Lai JSC (HAG), Hoang Anh Gia Lai Agricultural JSC (HNG), Pha Lai Thermal Power JSC (PPC), Thanh Thanh Cong Tay Ninh JSC (SBT), Masan Group Corp (MSN), Vinh Hoan Corp (VHC), Ho Chi Minh City Infrastructure Investment JSC (CII), Hoasen Group (HSG), Gemadept Corp (GMD), Petrovietnam Camau Fertilizer (DCM), Phu Nhuan Jewelry JSC (PNJ), PetroVietnam Drilling & Well Service Corp (PVD), PetroVietnam Power Nhon Trach 2 JSC (NT2), FPT Corp (FPT). La deuda total de estas empresas es más de 3 veces el EBITDA (el beneficio operativo principal del negocio, o las ganancias de la empresa en su día a día). Y eso es demasiado para mí. Necesitarían más de 3 años para pagar sus deudas. En vacas flacas, o en una gran recesión, el EBITDA puede bajar a la mitad, pero la deuda se mantendría. Eso significa que necesitarían bastante más de 6 años para pagar la deuda, lo que las obligaría a trabajar para la banca, si no algo peor.

La deuda total de estas empresas es más de 3 veces el EBITDA (el beneficio operativo principal del negocio, o las ganancias de la empresa en su día a día). Y eso es demasiado para mí. Necesitarían más de 3 años para pagar sus deudas. En vacas flacas, o en una gran recesión, el EBITDA puede bajar a la mitad, pero la deuda se mantendría. Eso significa que necesitarían bastante más de 6 años para pagar la deuda, lo que las obligaría a trabajar para la banca, si no algo peor.